4 releases

| 0.2.2 | May 4, 2023 |

|---|---|

| 0.2.1 | Apr 15, 2023 |

| 0.2.0 | Apr 14, 2023 |

| 0.1.0 | Apr 11, 2023 |

#332 in Finance

40 downloads per month

11KB

131 lines

Rustnance

Synopsis

A crate that provides functionality within the space of financial analysis

Explanation

This crate is meant to provide calculations as well as metrics and should not be seen as any financial or investing advice. The intent is to firstly develop calculation for fundamental analysis but technical analysis related functionality may be added. Some of the existing functions you will find consist of:

- Calculate intrinsic value

- Calculate compound interest

Usage

Inside your Cargo.toml

[dependencies]

rustnance = "0.2.1" # Latest version

Example usage

use rustnance::value; // Bring module into scope

fn main() {

let free_cash_flow: Vec<f32> = vec![1000.0, 2000.0, 3000.0, 4000.0, 5000.0]; // Historical free cash flow

let expected_return: f32 = 0.15; // The return you expect to achieve from an investment

let outstanding_shares: f32 = 1_000.0; // Amount of shares that excist for the specific company

let margin_of_safety: f32 = 0.3; // A margin of safety to take into account for the uncertainty of any calculation

let intrinsic_value: f32 = value::calculate_intrinsic_value(&free_cash_flow, &expected_return);

let intrinsic_value_per_share: f32 = value::intrinsic_value_per_stock(&intrinsic_value, &outstanding_shares);

let share_buy_price: f32 = value::margin_of_safety(&intrinsic_value_per_share, &margin_of_safety);

println!("A reasonable price would be: {}", share_buy_price);

}

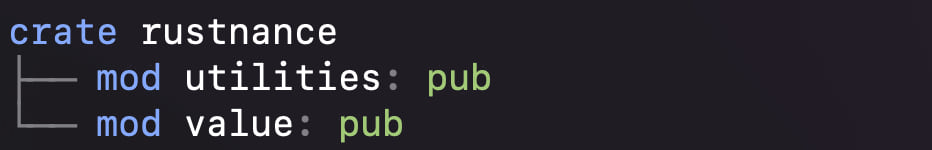

Module structure

Find a bug?

If you found a bug, an issue, an improvement or a potential addition to this project, please submit an issue(if it hasn't already been raised) using the issue tab towards the top. I intend to fix issues as they arise as well as add requested functionality.