199 releases (70 breaking)

| 0.77.0 | Oct 10, 2024 |

|---|---|

| 0.75.0 | Oct 10, 2024 |

| 0.71.4 | Jul 31, 2024 |

| 0.45.0 | Feb 27, 2024 |

| 0.5.7 | Mar 29, 2021 |

#40 in Finance

26 downloads per month

255KB

6K

SLoC

Leveraged Futures Exchange for Simulated Trading (LFEST)

☢️ This is a personal project, use a your own risk.

lfest-rs is a simulated perpetual futures exchange capable of leveraged positions.

You fed it external market data through the MarketUpdate enum to update the MarketState.

Where you either provide bid and ask price or information derived from a candle.

Macros (bba, candle) make it easy to construct the concrete variant.

For simplicity's sake (and performance) the exchange does not use an order book.

The exchange can be configured using Config and ContractSpecification

Features:

- 💱 Fixed point arithmetic using

fpdeccrate, for super fast and precise numeric calculations. - 🧠 Use of newtype pattern to enforce the correct types at function boundaries.

Examples include:

BaseCurrency,

QuoteCurrency,

Fee,

Leverage.

This makes it impossible to mistakenly input for example aUSDdenoted value into a function that expects aBTCdenoted value. - 📡 Flexible market data integration through the

MarketUpdatetype and associated macros. - 💹 Integrated performance tracking.

Use the existingFullAccountTracker

or implement your own using theAccountTrackertrait. - ✔️ good test coverage and heavy use of assertions, to get to ensure correctness.

- 🔍 Auditable due to its small and consice codebase.

- 📃 Supports both

linearandinversefutures contracts. - ⛔ Order filtering to make sure the price and quantity follow certain rules. See:

PriceFilter

QuantityFilter IsolatedMarginRiskEngine- Double-Entry Bookkeeping is used to ensure the accounting-equation always holds.

Order Types

The supported order types are:

Market: aggressively execute against the best bid / askLimit: passively place an order into the orderbook

Performance Metrics:

The following performance metrics are available when using the FullTrack AccountTracker,

but you may define any performance metric by implementing the AccountTracker trait.

win_ratio: wins / total_tradesprofit_loss_ratio: avg_win_amnt / avg_loss_amnttotal_rpnl: Total realized profit and losssharpe: The annualized sharpe ratiosortino: The annualized sortino ratiocumulative fees: Sum total of fees payed to the exchangemax_drawdown_wallet_balance: Maximum fraction the wallet balance has decreased from its high.max_drawdown_total: Drawdown including unrealized profit and lossmax_drawdown_duration: The duration of the longest drawdownnum_trades: The total number of trades executedturnover: The total quantity executedtrade_percentage: trades / total_trade_opportunitiesbuy_ratio: buys / total_tradeslimit_order_fill_ratiolimit_order_cancellation_ratiohistorical_value_at_riskcornish_fisher_value_at_riskd_ratio

There probably are some more metrics that I missed. Some of these metric may behave differently from what you would expect, so make sure to take a look at the code.

How to use

To use this crate in your project, add the following to your Cargo.toml:

[dependencies]

lfest = "*" # or lookup newest version on `crates.io`

Then proceed to use it in your code. For an example see examples

TODOs:

- proper liquidations (see

update_stateinExchange) - Orderbook support (with

MatchingEngine) - Funding rate (support

settle_funding_periodinClearingHouse) - Multiple accounts (low priority)

- Multiple markets (low priority)

- Portfolio

RiskEnginefor multiple markets akin toSPAN - Support for updating leverage of a position.

- Support auto-deleveraging

- Benchmarking

- more unit tests.

- fuzz testing?

Contributions

Would love to see you use and contribute to this project. Even just adding more tests is welcome.

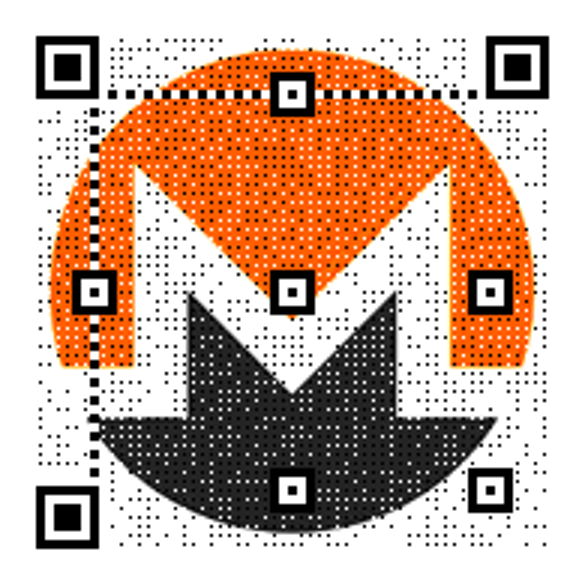

Donations 💰 💸

I you would like to support the development of this crate, feel free to send over a donation:

Monero (XMR) address:

47xMvxNKsCKMt2owkDuN1Bci2KMiqGrAFCQFSLijWLs49ua67222Wu3LZryyopDVPYgYmAnYkSZSz9ZW2buaDwdyKTWGwwb

License

Copyright (C) 2020 <Mathis Wellmann wellmannmathis@gmail.com>

This program is free software: you can redistribute it and/or modify it under the terms of the GNU Affero General Public License as published by the Free Software Foundation, either version 3 of the License, or (at your option) any later version.

This program is distributed in the hope that it will be useful, but WITHOUT ANY WARRANTY; without even the implied warranty of MERCHANTABILITY or FITNESS FOR A PARTICULAR PURPOSE. See the GNU Affero General Public License for more details.

You should have received a copy of the GNU Affero General Public License along with this program. If not, see https://www.gnu.org/licenses/.

Dependencies

~3–11MB

~113K SLoC